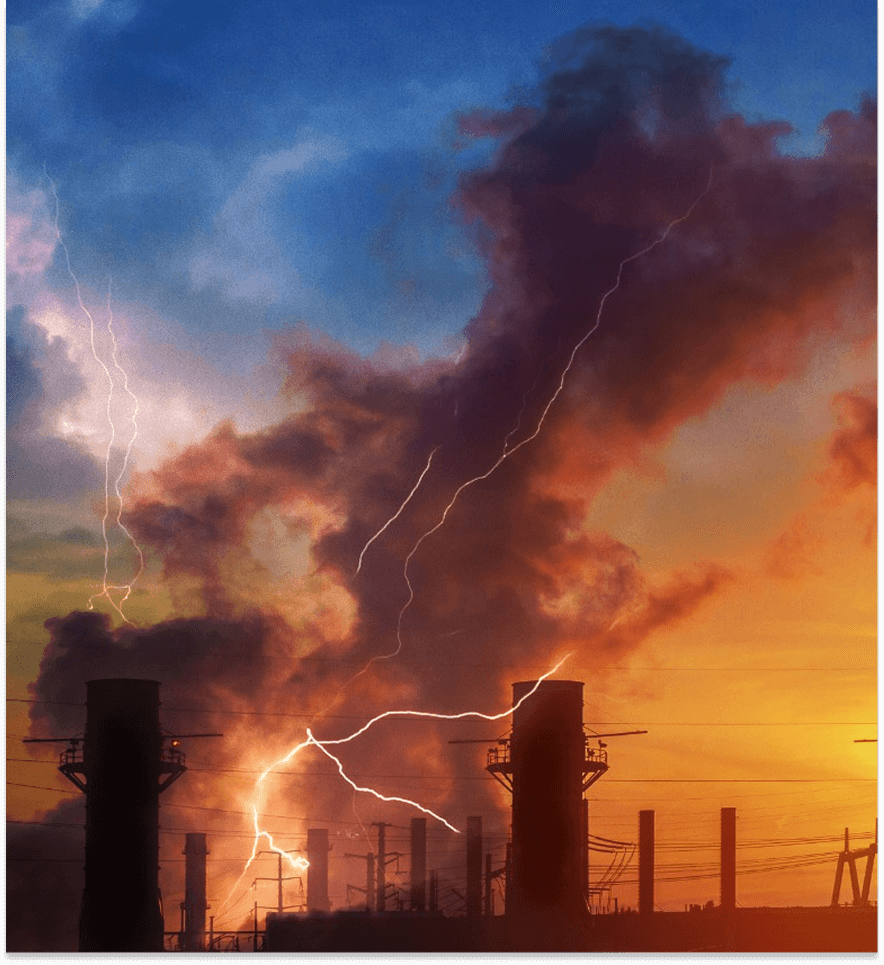

We provide treaty reinsurance protection for risks arising from fire and related perils, together with supplementary coverages.

Through treaty reinsurance, we offer tailored, long-term, and efficient solutions that ensure stability and provide sustainable coverage. In treaty reinsurance, policies belonging to a specific group of risks are automatically ceded to the reinsurer. This structure distributes risks across a broader portfolio, maintains financial stability, and supports sustained protection. Through our long-term partnerships, we promote prudent risk management and a resilient reinsurance framework.

Our Treaty Reinsurance team provides sustainable and long-term protection across Fire, Engineering, Marine, Liability, and Personal Accident lines of business, as well as Catastrophe exposures. Through strong partnerships established with cedants and brokers in both domestic and international markets, we deliver reliable capacity supported by robust technical expertise and a flexible underwriting approach.

We respond swiftly and effectively to our partners’ requirements, contributing to sound risk management and promoting balance and stability within the market.